Bima Diamond (841)

Product Summary :

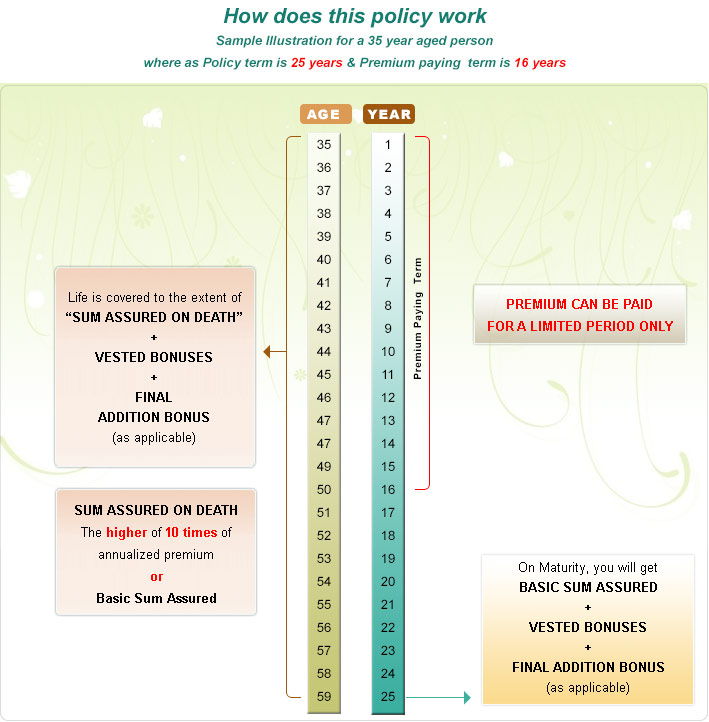

LIC's Bima Diamond Plan (841) is a non-linked, with-profits, limited premium payment money back type plan which offers a combination of protection and saving.

Premium Payment Mode:

Yearly, Halfly, Quarterly, Monthly(ECS)

Term

16 Year

20 Year

24 Year

Premium paying term.

For Term 16 Year Ppt 10 year

For Term 20 Year Ppt 12 Year

For Term 24 Year ppt 15 year

Minimum Entry Age :

14 Year Completed

Maximum Entry Age :

For Term 16Year - 50 Year (Nearest Birthday)

For Term 20 Year - 45 Year (Nearest Birthday)

For Term 24 Year - 41 Year (Nearest Birthday)

Maximum Maturity Age :

For Term 16Year - 66 Year

For Term 20 & 24 Year - 65 Year

Minimum Sum Assured :

1,00,000

Maximum Sum Assured :

5,00,000

Extended Cover after Completion of Policy term. Extended Cover Period equal to half of the policy term.

Policy Benefits :

On Death :

On death during first five policy years:

Sum-Assured on death

On death after five policy years:

Sum-Assured on death + Loyalty addition if any.

where Sum-Assured on death is Basic Sum-Assured,OR

10 times of Annualized Premium, OR

105%of all Premiums paid as on death,

WHICHEVER IS HIGHER.

On Survival :

For Term 16:

15% of Basic SA is payable after 4th, 8th and 12th year of policy.

Maturity Time 55% of Basic Sum Assured + Loyalty addition if any.

For Term 20:

15% of Basic SA is payable after 4th, 8th , 12th and 16th year of policy.

Maturity Time 40% of Basic Sum Assured + Loyalty addition if any.

For Term 24:

12% of Basic SA is payable after 4th, 8th , 12th , 16th and 20th year of policy.

Maturity Time 40% of Basic Sum Assured + Loyalty addition if any.

Surrendered Value :

The Policy can be surrendered at any time during the policy term provided atleast three full years premiums have been paid.

Loan :

Loan Facillity is available under this plan, after payment of premiums for at least 3 full years.

Income Tax Benefit :

• Premium paid under this plan is eligible for TAX rebate under section 80c.

• Maturity under this plan is free under sec 10(10D).

Proposal Form : 300/340/360 shall be used under this plan.