Who is a ‘Politically Exposed Person’ and does it matter?

If you are a politically exposed person (PEP) or subsequently qualify as one, your transactions would be closely monitored by the anti-money laundering committee of the mutual fund company

Once you declare yourself as a ‘politically exposed person’, financial institutions do additional due diligence.

If you want to start investing in a mutual fund, you first have to complete the KYC process and declare whether or not you’re a politically exposed person (PEP). How do you know if you’re a PEP and why does it matter?

PEP is a person who is authorised to perform prominent public functions in a country and include governors of state, members of Parliament, military officers, senior government and judicial executives and heads of local bodies such as municipal corporations, among others. You could also qualify as a PEP if you are a family member or a close relative of such an individual.

The Securities and Exchange Board of India (SEBI), in its circular dated 19 December 2008, mandated mutual fund companies to capture this category of investors. It came into effect in 2009. “All registered intermediaries are required to obtain senior management approval for establishing business relationships with Politically Exposed Persons,” stated the circular.

Why does it matter?

Once you declare yourself as a PEP, financial institutions such as banks and mutual fund houses do additional due diligence while processing your application as a preventive measure to avoid any possible fraud in the future.

Mutual fund companies have made it mandatory for customers to declare this because guidelines under the Prevention of Money Laundering Act and Combating Financing of Terrorism (CFT) necessitate the senior management of financial institutions to approve the PEP before establishing any business relationship.

If you are a PEP or subsequently qualify as one, your transactions would be closely monitored by the anti-money laundering committee of the mutual fund company to keep track of the inflow and outflow of money. If there is any change in the pattern or amount of transaction, it could be noted by the committee as a “suspicious transaction” and there maybe further investigation. Large and complex transactions between the customer and her known relations without any economic rationale are tracked.

The Reserve Bank of India (RBI), in its circular, dated 1 July 2008, instructed all banks to gather sufficient data about PEPs looking to open a new account by checking all information available in public domain. “Banks should verify the identity of the person and seek information about the sources of funds before accepting the PEP as a customer. The decision to open an account for a PEP should be taken at a senior level which should be clearly spelt out in customer acceptance policy,” stated the circular.

In 2015, the Insurance Regulatory and Development Authority of India (Irdai) also directed all insurers to ensure appropriate risk management procedures for identifying and applying advanced due diligence measures to PEPs. “It is emphasized that proposals of (PEPs) in particular requires approval of senior management, not below the level of Head (underwriting) or chief risk officer,” stated Irdai.

the Financial Action Task Force (FATF). The FATF defines a PEP as:

a current or former senior official in the executive, legislative, administrative, military, or judicial branch of a government (elected or not)a senior official of a major political partya senior executive of a government owned commercial enterprise, being a corporation, business or other entity formed by or for the benefit of any such individualan immediate family member of such individual; meaning spouse, parents, siblings, children, and spouse’s parents or siblingsany individual publicly known (or actually known by the relevant financial institution) to be a close personal or professional associate.

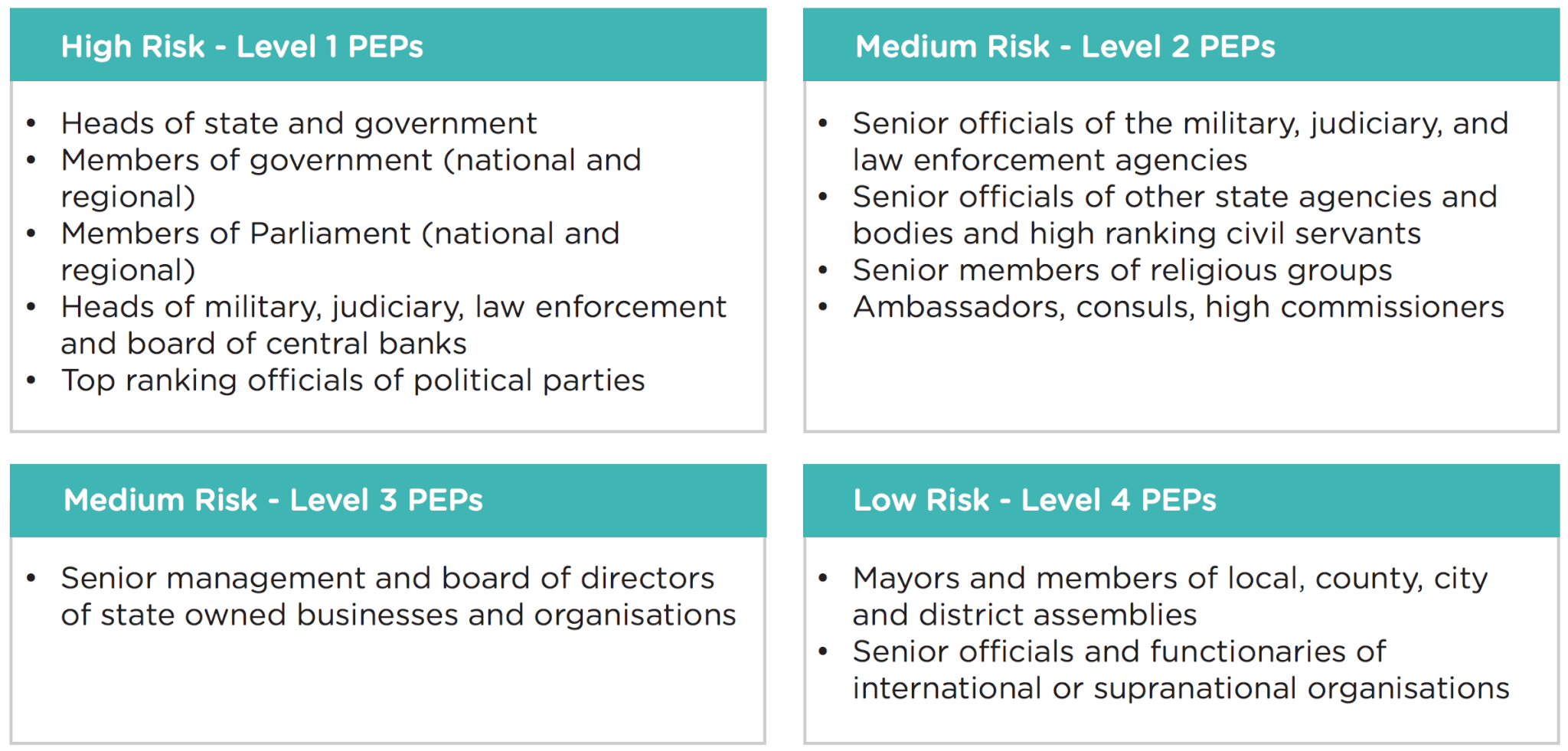

Different types of PEP are usually regarded as presenting different levels of risk. The below categorisations are not intended to be absolute, but might prove useful in thinking about which PEPs require the most careful due diligence work.

If you fall under the PEP category, your KYC and customer due diligence process could get enhanced and take a fairly longer time than usual with the requirement of some additional documents. If you’re a PEP and your transactions are legitimate and do not spark a suspicion, you don’t have to stress over this declaration.

கருத்துகள் இல்லை:

கருத்துரையிடுக