LIC's Jeevan Shanthi

Plan No. 850

Highlights:

Pay Single Premium and get Guaranteed pension for Lifetime

Choose from

1. Immediate pension or deferred pension options

2. Joint life pension or increasing income every year

Death benefit in lumpsum or in yeraly installmentsLoan availability after completion of 1 year

Tax Benefit on premiums paid u/s 80C

Product Info:Jeevan Shanti is a Single Premium Payment plan with guaranteed pension for lifetimeIt has multiple options of taking pension from joint life pension for lifetime or increasing pension every yearThe pension can be commenced immediately, or it can also be deferredGuaranteed Bonus which will be added every month to the policyThe loan is available after the completion of 1 YearThe NPS subscribers can also opt for this pension planDeath benefit can be availed in lumpsum or in installmentsThe policy holder will get the tax benefit u/s 80C

Advantages

Conditions

Eligibility

Minimum Age at Entry: 30 Years

Minimum Purchase price:₹ 1,50,000/- subject to Minimum Annuity as specified below

Minimum Annuity:

Annuity Mode | Monthly | Quarterly | Half-yearly | Yearly |

Annuity | ₹ 1,000/- per month | ₹ 3,000/- per quarter | ₹ 6,000/- per half year | ₹ 12,000/- per annum |

Maximum Age at Entry:

- Immediate Annuity: 85 years (last birthday) except Option F

100 years (last birthday) for Option F

- Deferred Annuity: 79 years (last birthday)

Minimum Deferment Period: 1 Year

Maximum Deferment Period: 20 Year

Minimum Vesting Age: 31 years (last birthday)

Maximum Vesting Age: 80 years (last birthday)

Annuity Mode : Yearly, Half yearly, Quarterly and Monthly

Joint Life: The joint life annuity can be taken between any lineal descendant/ascendant of a family (i.e. Grandparent, Parent, Children, Grandchildren) or spouse or siblings.

Pension Option :

Immediate Annuity --

Annuity Options | Annuity Description |

Option A | Immediate Annuity for life |

Option B | Immediate Annuity with a guaranteed period of 5 years and life thereafter |

Option C | Immediate Annuity with a guaranteed period of 10 years and life thereafter |

Option D | Immediate Annuity with a guaranteed period of 15 years and life thereafter |

Option E | Immediate Annuity with a guaranteed period of 20 years and life thereafter |

Option F | Immediate Annuity for life with return of Purchase Price |

Option G | Immediate Annuity for life increasing at a simple rate of 3% p.a. |

Option H | Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on the death of the Primary Annuitant |

Option I | Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives. |

Option J | Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on the death of the last survivor |

Deferred Annuity –

Annuity Options | Annuity Description |

Option 1 | Deferred annuity for Single life |

Option 2 | Deferred annuity for Joint life |

Why to Buy Jeevan Shanti Plan?

3. Tax benefits

As per section 80 c and 80 d tax benefits can be availed from this plan. One time premium that is paid can be completely covered in the payment of tax.

4. Easy of buying

The best part of this plan is it can be purchased through LIC Dhamodharan.

5. Guaranteed Income

By investing in this plan there is surety of monthly income that policyholder can get. Period of Income is applicable for the lifetime. In some options, there's guarantee of Income even if the annuitant dies in between. It is completely based on the option that we have chosen.

6. Assured returns

In case of the deferred plan there' surety of getting returns. These returns are added every month to the policy. After the deferred period, benefits can be availed.

Immediate or Deferred Annuity, Which Type or Option to Choose From?

Jeevan Shanti plan of LIC got 2 types of annuity that have got many options to choose. It may be a daunting task to select the suitable from so many options. With the small analogy, it may be easier to decide. Both types of annuity plan got its pros and cons. The suitable plan is based on our requirement completely. Shown below options from both immediate as well as deferred.

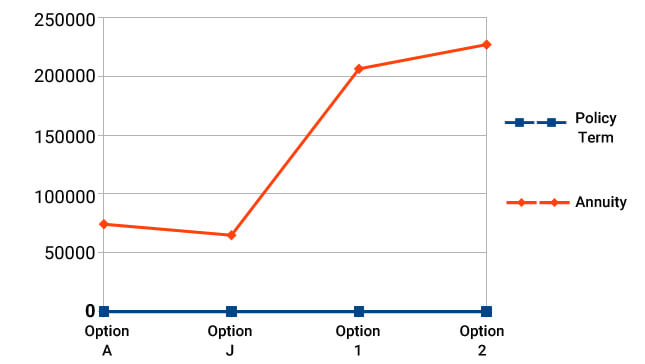

Jeevan Shanti Graph

(Assumed Investment is Rs.10,00,000. Proposar Age assumed is 42 years )

கருத்துகள் இல்லை:

கருத்துரையிடுக